When Markets Diverge: Why Capital Preservation Trumps Speculation in 2026

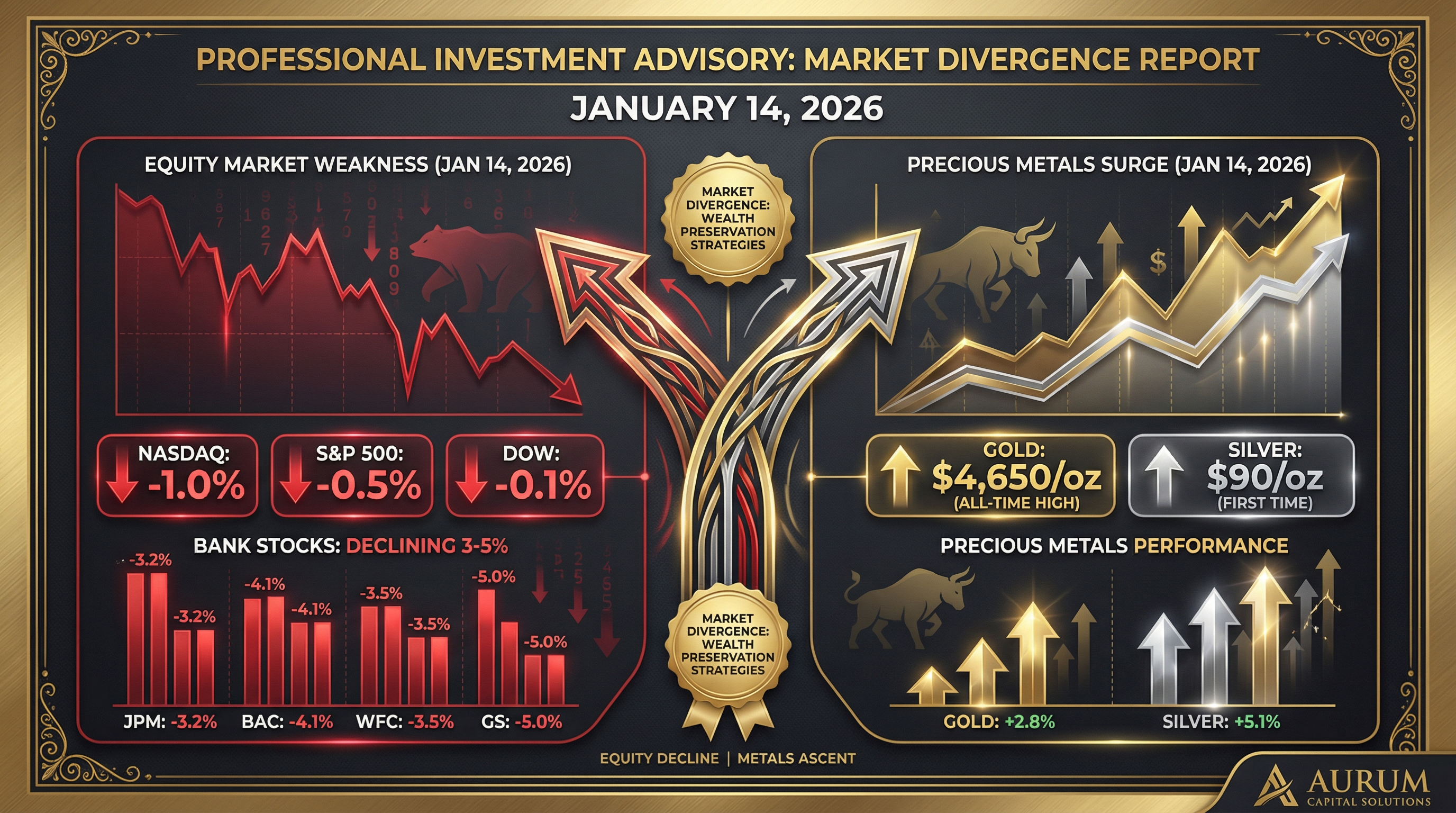

On January 14th, 2026, equity markets experienced a notable pullback while precious metals surged to all-time highs. The S&P 500 declined 0.5%, the NASDAQ fell 1.0%, and the DOW dropped 0.1%, while gold reached $4,650/oz and silver climbed to $31/oz. This divergence is not random. It signals a fundamental shift in investor sentiment and priorities.

The Market Divergence Explained

When equities fall while precious metals surge, it typically indicates one of two scenarios: either investors are fleeing risk assets in favor of safe havens, or they're pricing in inflation expectations that make tangible assets more attractive. In this case, both dynamics are at play.

The weakness in equities reflects concerns about earnings growth, interest rate persistence, and regulatory headwinds. Bank stocks, in particular, declined 3.5% as investors reassess the profitability of traditional banking in a higher-for-longer rate environment. Technology stocks, despite their recent strength, showed signs of fatigue as investors questioned whether current valuations are justified.

Why Capital Preservation Is Reasserting Itself

For decades, the investment narrative has centered on growth at any cost. Momentum investing, high-conviction bets, and concentrated portfolios dominated the landscape. But 2026 is different. Sophisticated investors are asking a new question: "How do I keep what I have?"

This shift reflects three realities:

1. Preserve Capital First - In volatile markets, the ability to avoid catastrophic drawdowns matters more than capturing every upside. A portfolio that declines 10% in bad years but captures 80% of upside in good years will outperform a portfolio that gains 15% annually but experiences 40% drawdowns.

2. Demand Quality Over Quantity - Not all equities are created equal. Companies with strong balance sheets, predictable cash flows, and competitive moats are attracting capital away from speculative, high-growth names. This is why dividend aristocrats and quality factors are outperforming.

3. Embrace Regulatory Risk - Investors are recognizing that regulatory frameworks, while sometimes restrictive, provide stability and predictability. Companies operating in well-regulated industries with clear rules of engagement are becoming more attractive than those in regulatory gray zones.

What This Means for Your Portfolio

If you're holding concentrated positions in high-growth technology or speculative assets, this market signal warrants a review. Not a panic sell, but a thoughtful rebalancing toward:

The Kairross Approach

At Kairross, we've built our entire framework around capital preservation as the foundation for durable growth. We don't chase momentum. We don't concentrate risk. Instead, we analyze market signals like the current divergence between equities and precious metals, adjust our positioning accordingly, and maintain discipline across market cycles.

Our members receive detailed analysis of these market inflection points, along with actionable recommendations for portfolio positioning. We believe that in 2026, this disciplined approach will be more valuable than ever.

The market has spoken. Capital preservation is back in favor. The question is: are you positioned accordingly?